It is important that your correct bank account with correct IFSC is linked to your Universal Account Number (UAN) to receive the credit of EPF funds timely.

To withdraw funds from your Employees’ Provident Fund (EPF) account it is important that your correct bank account details be recorded in the EPF account. This is necessary to ensure timely credit of the EPF funds withdrawn into your bank account. This becomes all the more important in the current scenario.

The Employees’ Provident Fund Organisation (EPFO), announced in March, 2020 that its members can withdraw money from their EPF corpus to tide over financial emergencies caused due to the coronavirus-induced lockdown.

The retirement fund body, via its Twitter handle, has asked members to provide the correct bank account details or to update their bank account details for timely credit of EPF funds at the time of withdrawal.

Here is a look at how you can check and update your bank account details in your EPF account.

What is required to make EPF withdrawal?

Saraswathi Kasturirangan, Partner, Deloitte India says, “To make a withdrawal from EPF account as allowed as per the EPF scheme rules, it is important that your active bank account with correct IFSC is linked to your Universal Account Number (UAN). If the correct bank account is not linked with the EPF account, then the credit of funds withdrawn from EPF will be delayed.”

How to check bank account details in EPF records

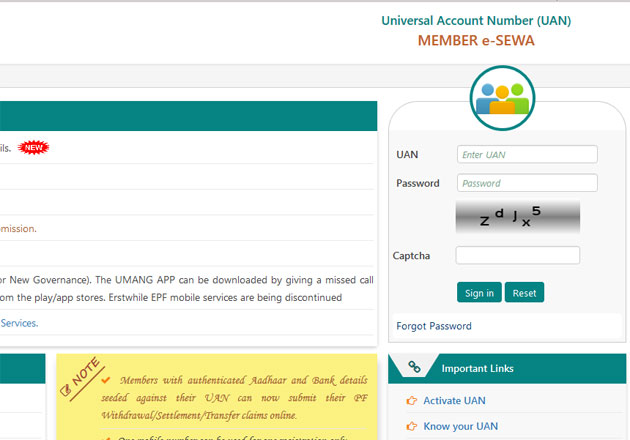

Step 1: Visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and log in to your account.

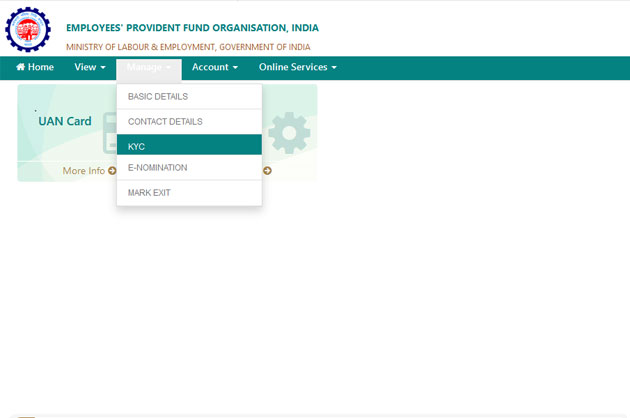

Step 2: Once logged in, click on ‘KYC option’ under the ‘Manage’ tab.

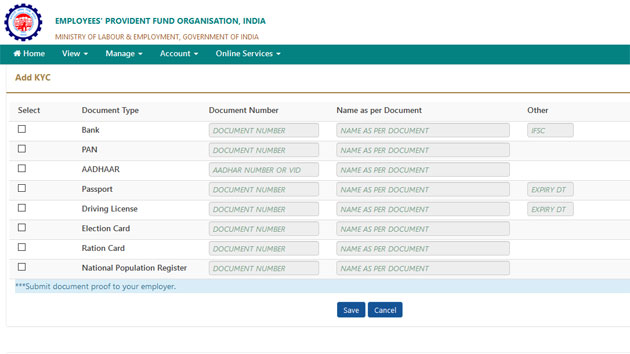

Step 3: A new webpage will appear on your screen. Under the ‘Digitally Approved KYC’, check the bank account details, i.e., the name of the bank, bank account number and IFSC.

If the bank account details are correct, then the EPF withdrawal claim will be credited into the bank account shown. If the bank account details are incorrect, then you will be required to provide the correct bank account details to receive the EPF withdrawal money.

How to update bank account details in EPF records

Step 1: Log into your account on https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Select the KYC option under the Manage Tab

Step 3: Select Document type – Bank. Add the correct bank account number where the webpage asks you to mention document number, name as per the bank records and IFSC.

Step 4: Click on ‘Save’.

Once the details are saved, the details will be shown under the ‘KYC Pending for Approval’ tab.

Remember, the bank account details must be approved by your employer to be updated in EPFO’s records. To hasten the process, the employee should ask his/her employer to approve the change of bank account details in the EPFO’s records.

Kasturirangan says, “Once the employer has approved the change, it usually takes about a week for the change to be reflected in EPFO records.”

Point to remember

To access your account on the EPFO’s Member e-Sewa portal, your UAN must be active. Click here to know how to activate your UAN.

Need Information or Confused about Something ?

Ask a QuestionTable of Contents

Related Resources

Student Loans in South Africa: How to Apply and What to Expect

For many young South Africans, accessing higher education is a dream that often comes with a financial challenge. Fortunately, several student loan optionsstrong> are available in South Africa to help fund university, college, or TVET studies. Whether you’re looking for a government loan like NSFAS or a private student loan from a bank, understanding the process is essential for success.

What Are Student Loans?

Student loans are a form of financial aid provided to eligible students to help cover tuition fees, books, accommodation, and other study-related expenses. In South Africa, these loans can come from government institutions like NSFAS or private banks such as Nedbank, Standard Bank, FNB, and Absa. Most loans offer repayment flexibility and low-interest options until you graduate.

Types of Student Loans in South Africa

- NSFAS (National Student Financial Aid Scheme): A government-funded loan/grant program for students from low-income households. Covers tuition, housing, transport, and meals.

- Bank Student Loans: Offered by most major banks. These are credit-based and require a guardian or parent as a co-signer.

- Private Loan Providers: Companies like Fundi offer educational loans covering various costs such as school fees, gadgets, and textbooks.

Requirements to Qualify for a Student Loan

Each provider has its own criteria, but most South African student loans require the following:

- Proof of South African citizenship or permanent residency

- Proof of registration or acceptance at a recognised tertiary institution

- Parent or guardian with a stable income to co-sign (for private loans)

- Completed application form with supporting documents (ID, proof of income, academic records)

How to Apply for a Student Loan

To apply for a student loan in South Africa, follow these steps:

- Identify your loan provider: Choose between NSFAS, a bank, or a private lender.

- Gather necessary documents: ID copies, academic transcripts, acceptance letters, and income statements.

- Complete the application form online or at a branch.

- Await approval: Some banks offer instant decisions, while NSFAS can take a few weeks.

- Receive disbursement: Funds are typically paid directly to the institution or your account, depending on the lender.

Loan Amounts and Repayment

The loan amount you can receive depends on your chosen lender and financial need:

- NSFAS: Covers full tuition, residence, books, and a personal allowance. The loan becomes a bursary if you pass all your courses.

- Banks: Can provide up to R120,000 or more annually, depending on tuition costs and credit history.

Repayment usually starts after graduation or once you start earning an income. Bank loans may require interest-only payments during your studies. NSFAS repayment only begins when you earn above a specific income threshold.

FAQs on Student Loans in South Africa

1. Can I apply for a student loan without a parent or guardian?

For government loans like NSFAS, yes. But most banks require a financially responsible co-signer, especially for students without an income.

2. Is NSFAS a loan or a bursary?

NSFAS starts as a loan, but it converts to a bursary if you meet academic performance requirements. This means you may not have to pay it back.

3. What is the interest rate on student loans?

Private banks offer competitive rates between 5% and 12%, depending on the applicant's credit profile. NSFAS charges a much lower interest rate, usually linked to inflation.

4. What happens if I fail my courses?

If you’re funded by NSFAS and fail, your loan won’t convert into a bursary, and you’ll need to repay the full amount. Banks may continue charging interest, and your co-signer may be held liable.

5. Can I use a student loan to pay for accommodation and laptops?

Yes. Both NSFAS and many bank student loans cover costs beyond tuition, including housing, meals, textbooks, and electronic devices like laptops or tablets.

Final Thoughts

Student loans in South Africa offer a much-needed financial lifeline to thousands of students every year. Whether you're applying through **NSFAS** or a private bank, ensure you understand the **terms, interest rates, and repayment conditions** before signing any agreement. Make informed decisions today to secure your academic and financial future tomorrow.