17

∙Gauteng has the most active suppliers on the site with 68.50% of views, followed byKwaZulu-Natal with 11.45%, Western Cape with 10.73% and Limpopo with 2.55% views. This

information clearly identifies the areas where stakeholder engagement could improve.

Demographic Statistics

∙61% of people accessing the portal are under the age of 34. With the youth already adopting technology, we should focus on the other age groups, especially during supplier engagement and outreach programmes.

∙45.85% of visitors are female and 54.15% are male.

Q:The use of the eTender Publication Portal only is in direct conflict with departmental policies. Departmental policies should be aligned to Instruction 1 of 2015, which was issued on

1 April 2015 and was effective from 1 May 2015.

Q:How do we deal with/address the need for deviations when using the eTender Publication Portal?

No deviations will be considered. To ensure transparency, all tender opportunities must be recorded on the eTender Publication Portal.

Q:When publishing the results of tenders on the eTender Publication Portal, why don’t we list successful bidders only?

To ensure transparency, all evaluation results must be published. Integration to the CSD will soon make this process much easier and reduce duplication.

Q:There are too many forms for us to fill in to publish tenders on the eTender Publication Portal. Can we use the CSD to capture all the forms?

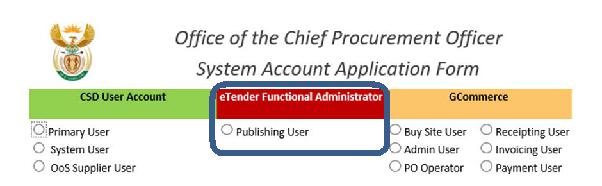

OoS are encouraged to apply for access to publish their own tenders on the eTender Publication portal. All OCPO System access requests can be filled in on the same form used for the CSD. Select the “eTender Functional Administrator (Publishing User)” role. Once completed and signed, please send your request to eTenders@treasury.gov.za.

Q:When a user creates a tender on the portal, other users cannot access this. Can you grant special access to more than one user so that in the event of the user not being available, a colleague can access the portal?

Unfortunately, this function is not available at the moment. With the new release scheduled for 1 July 2016, we will enable Role Based Authentication and organisational access to bids.

Student Loans in South Africa: How to Apply and What to Expect

For many young South Africans, accessing higher education is a dream that often comes with a financial challenge. Fortunately, several student loan optionsstrong> are available in South Africa to help fund university, college, or TVET studies. Whether you’re looking for a government loan like NSFAS or a private student loan from a bank, understanding the process is essential for success.

What Are Student Loans?

Student loans are a form of financial aid provided to eligible students to help cover tuition fees, books, accommodation, and other study-related expenses. In South Africa, these loans can come from government institutions like NSFAS or private banks such as Nedbank, Standard Bank, FNB, and Absa. Most loans offer repayment flexibility and low-interest options until you graduate.

Types of Student Loans in South Africa

- NSFAS (National Student Financial Aid Scheme): A government-funded loan/grant program for students from low-income households. Covers tuition, housing, transport, and meals.

- Bank Student Loans: Offered by most major banks. These are credit-based and require a guardian or parent as a co-signer.

- Private Loan Providers: Companies like Fundi offer educational loans covering various costs such as school fees, gadgets, and textbooks.

Requirements to Qualify for a Student Loan

Each provider has its own criteria, but most South African student loans require the following:

- Proof of South African citizenship or permanent residency

- Proof of registration or acceptance at a recognised tertiary institution

- Parent or guardian with a stable income to co-sign (for private loans)

- Completed application form with supporting documents (ID, proof of income, academic records)

How to Apply for a Student Loan

To apply for a student loan in South Africa, follow these steps:

- Identify your loan provider: Choose between NSFAS, a bank, or a private lender.

- Gather necessary documents: ID copies, academic transcripts, acceptance letters, and income statements.

- Complete the application form online or at a branch.

- Await approval: Some banks offer instant decisions, while NSFAS can take a few weeks.

- Receive disbursement: Funds are typically paid directly to the institution or your account, depending on the lender.

Loan Amounts and Repayment

The loan amount you can receive depends on your chosen lender and financial need:

- NSFAS: Covers full tuition, residence, books, and a personal allowance. The loan becomes a bursary if you pass all your courses.

- Banks: Can provide up to R120,000 or more annually, depending on tuition costs and credit history.

Repayment usually starts after graduation or once you start earning an income. Bank loans may require interest-only payments during your studies. NSFAS repayment only begins when you earn above a specific income threshold.

FAQs on Student Loans in South Africa

1. Can I apply for a student loan without a parent or guardian?

For government loans like NSFAS, yes. But most banks require a financially responsible co-signer, especially for students without an income.

2. Is NSFAS a loan or a bursary?

NSFAS starts as a loan, but it converts to a bursary if you meet academic performance requirements. This means you may not have to pay it back.

3. What is the interest rate on student loans?

Private banks offer competitive rates between 5% and 12%, depending on the applicant's credit profile. NSFAS charges a much lower interest rate, usually linked to inflation.

4. What happens if I fail my courses?

If you’re funded by NSFAS and fail, your loan won’t convert into a bursary, and you’ll need to repay the full amount. Banks may continue charging interest, and your co-signer may be held liable.

5. Can I use a student loan to pay for accommodation and laptops?

Yes. Both NSFAS and many bank student loans cover costs beyond tuition, including housing, meals, textbooks, and electronic devices like laptops or tablets.

Final Thoughts

Student loans in South Africa offer a much-needed financial lifeline to thousands of students every year. Whether you're applying through **NSFAS** or a private bank, ensure you understand the **terms, interest rates, and repayment conditions** before signing any agreement. Make informed decisions today to secure your academic and financial future tomorrow.