Table of Contents

online.natis.gov.za Check Your Licence Card : National Traffic Information System

Organization : National Traffic Information System

Service Name : Check Your Licence Card

Applicable For : Citizen of South Africa

Website : https://online.natis.gov.za/#/

NATIS Check Your Licence Card

This service is used to validate and check your licence card

How to Book?

Just follow the below steps to Check Your Licence Card

Steps :

Step 1 : Visit the official website of National Traffic Information System through provided above.

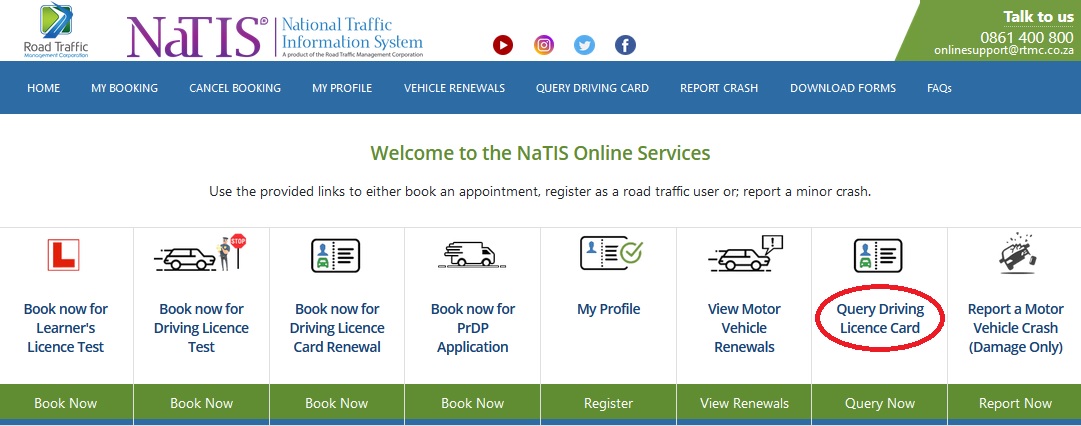

Step 2 : Next, Click on the “Query Driving Licence Card” link in the home page.

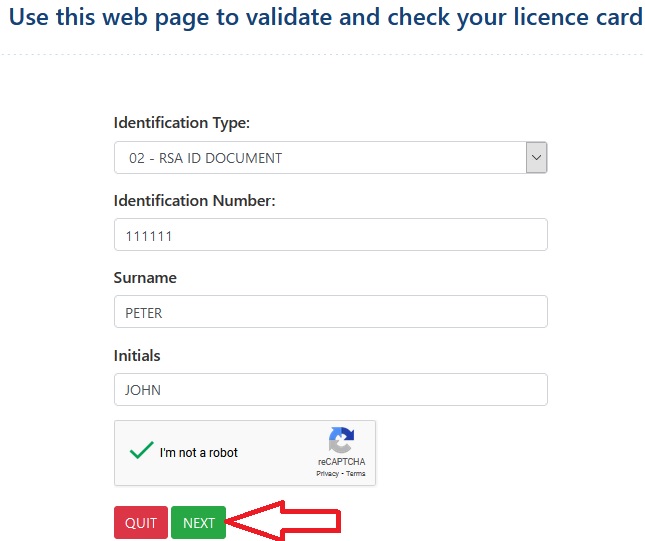

Step 3 : Fill the application with the following details and click on the “Next” button

** Select the Identification Type

** Enter Your Identification Number

** Enter Your Surname

** Enter Your Initials

Step 4 : After that, fill the remaining details to check your card.

Slots Information

Please take note of the following information

The Gauteng Department of Roads and Transport (GDRT) together with all their Driving Licence Testing Centres (DLTC’s), have decided to streamline booking information.

Please note the following :

** The daily tabs above,indicate when SLOTS for specific services will be opened on the website.

** For example, all DLTC’s will ONLY open slots for Driving Licence and Learner’s Licence Testing on a Tuesday.

** All slots opened on a day is released from after 08h00 in the morning until 20h00 in the evening.

On a Monday :

All 38 DLTCs will open slots for the following services ONLY

** Renewal of Driving Licence Cards and

** PrDP Applications

On a Tuesday :

All 38 DLTCs will open slots for the following services ONLY

Driving Licence Testing and

Learner’s Licence Testing

Please note :

If you managed to make a booking for Driving Licence or Learner’s Licence Test then you must confirm and pay for your booking within 3 days

On a Wednesday :

** On a Wednesday NO DLTC will open Slots.

** If you see any slots for any service it may be left over from the previous day.

** Any person 60 years and older can go to any DLTC to renew their Driving Licence or apply for a PrDP

On a Thursday :

The system in the background will have slots available for PRIORITY renewal of Driving Licence Cards and PrDP Applications.

1. What is a Priority slot?

A priority slot is for a person whose Driving Licence or PrDP has already expired.

2. How will the system know that I am a priority?

When you enter your Identity number, the system checks if your Driving Licence or PrDP has already expired, if so, then you will see a priority slot (if such a slot is available)

3. If my Driving Licence or PrDP has expired and there are no priority slots available, what then?

The system will then show you slots that all other applicants will see, whose Driving Licence or PrDP has not yet expired.

FAQs

1. What is this online service about?

This service is to provide convenience to the public to

1.1.1 Register Profile online and capture their contact details to receive electronic communication from NaTIS. By registering a profile online vehicle owners will be able to obtain their motor vehicle renewal notice (MVL2) two months prior to the expiry date of the vehicle license before going to nearest NaTIS service centre (Post Office or Registering Authority) to renew their license.

1.1.2 Make Bookings to apply for Learner Licence, Driving License and/or Professional Driving Permits, without having to visit Traffic Departments not having the guarantee of being assisted after standing in long queues.

1.1.3 Report Motor Vehicle Crashes that just occurred, by using the smart devices without having to queue on the call to report the incidents to South Africa Police Services, Insurances or Emergency Rescuers.

2. Who is this service for?

This service is for any member of the South African public with a valid South African identity document, foreign identity document, Traffic Register Number (TRN) or Business Register Number (BRN) who would like to register their profile online and obtain their vehicle renewal notices, make an online booking or report motor vehicle crash.

3. Who can I contact if I have a problem?

A telephone number is available on the website as well as an email address that can be used to report any difficulties or problems experienced. For any problems or enquiries please contact our call centre via email – onlinesupport [AT] rtmc.co.za or contact us on 0861 400 800 to assist.

Need Information or Confused about Something ?

Ask a QuestionRelated Resources

Student Loans in South Africa: How to Apply and What to Expect

For many young South Africans, accessing higher education is a dream that often comes with a financial challenge. Fortunately, several student loan optionsstrong> are available in South Africa to help fund university, college, or TVET studies. Whether you’re looking for a government loan like NSFAS or a private student loan from a bank, understanding the process is essential for success.

What Are Student Loans?

Student loans are a form of financial aid provided to eligible students to help cover tuition fees, books, accommodation, and other study-related expenses. In South Africa, these loans can come from government institutions like NSFAS or private banks such as Nedbank, Standard Bank, FNB, and Absa. Most loans offer repayment flexibility and low-interest options until you graduate.

Types of Student Loans in South Africa

- NSFAS (National Student Financial Aid Scheme): A government-funded loan/grant program for students from low-income households. Covers tuition, housing, transport, and meals.

- Bank Student Loans: Offered by most major banks. These are credit-based and require a guardian or parent as a co-signer.

- Private Loan Providers: Companies like Fundi offer educational loans covering various costs such as school fees, gadgets, and textbooks.

Requirements to Qualify for a Student Loan

Each provider has its own criteria, but most South African student loans require the following:

- Proof of South African citizenship or permanent residency

- Proof of registration or acceptance at a recognised tertiary institution

- Parent or guardian with a stable income to co-sign (for private loans)

- Completed application form with supporting documents (ID, proof of income, academic records)

How to Apply for a Student Loan

To apply for a student loan in South Africa, follow these steps:

- Identify your loan provider: Choose between NSFAS, a bank, or a private lender.

- Gather necessary documents: ID copies, academic transcripts, acceptance letters, and income statements.

- Complete the application form online or at a branch.

- Await approval: Some banks offer instant decisions, while NSFAS can take a few weeks.

- Receive disbursement: Funds are typically paid directly to the institution or your account, depending on the lender.

Loan Amounts and Repayment

The loan amount you can receive depends on your chosen lender and financial need:

- NSFAS: Covers full tuition, residence, books, and a personal allowance. The loan becomes a bursary if you pass all your courses.

- Banks: Can provide up to R120,000 or more annually, depending on tuition costs and credit history.

Repayment usually starts after graduation or once you start earning an income. Bank loans may require interest-only payments during your studies. NSFAS repayment only begins when you earn above a specific income threshold.

FAQs on Student Loans in South Africa

1. Can I apply for a student loan without a parent or guardian?

For government loans like NSFAS, yes. But most banks require a financially responsible co-signer, especially for students without an income.

2. Is NSFAS a loan or a bursary?

NSFAS starts as a loan, but it converts to a bursary if you meet academic performance requirements. This means you may not have to pay it back.

3. What is the interest rate on student loans?

Private banks offer competitive rates between 5% and 12%, depending on the applicant's credit profile. NSFAS charges a much lower interest rate, usually linked to inflation.

4. What happens if I fail my courses?

If you’re funded by NSFAS and fail, your loan won’t convert into a bursary, and you’ll need to repay the full amount. Banks may continue charging interest, and your co-signer may be held liable.

5. Can I use a student loan to pay for accommodation and laptops?

Yes. Both NSFAS and many bank student loans cover costs beyond tuition, including housing, meals, textbooks, and electronic devices like laptops or tablets.

Final Thoughts

Student loans in South Africa offer a much-needed financial lifeline to thousands of students every year. Whether you're applying through **NSFAS** or a private bank, ensure you understand the **terms, interest rates, and repayment conditions** before signing any agreement. Make informed decisions today to secure your academic and financial future tomorrow.